30% AMI (Extremely Low Income) - Target Population: Households with very limited income, often receiving public assistance. Income Limits: 1 person: $28,350, 2 people: $32,400, 3 people: $36,450, 4 people: $40,450. Typical Rent: $700–$1,000/month.

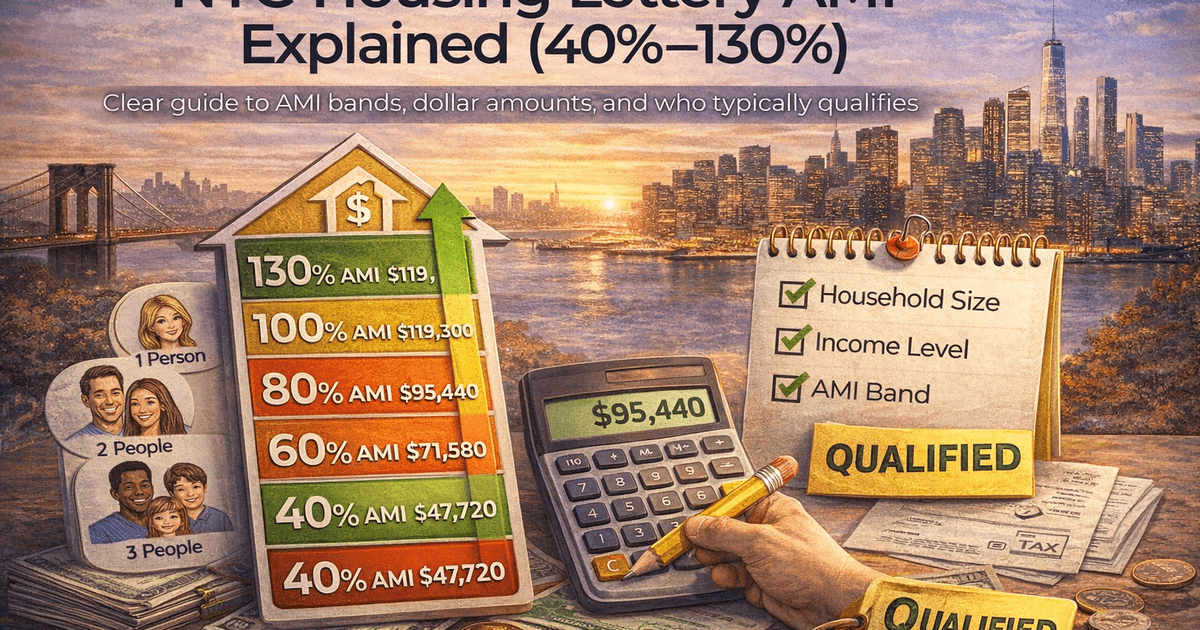

40% AMI (Very Low Income) - Target Population: Working households with limited income. Income Limits: 1 person: $37,800, 2 people: $43,200, 3 people: $48,600, 4 people: $53,950. Typical Rent: $950–$1,350/month.

50% AMI (Low Income) - Target Population: Low-wage workers, service industry employees. Income Limits: 1 person: $47,250, 2 people: $54,000, 3 people: $60,750, 4 people: $67,450. Typical Rent: $1,180–$1,680/month.

60% AMI (Low Income – Most Common) - Target Population: Entry-level professionals, public sector workers, families with multiple earners. Income Limits: 1 person: $56,700, 2 people: $64,800, 3 people: $72,900, 4 people: $80,900. Typical Rent: $1,420–$2,020/month. Note: 60% AMI is the most common income band for NYC housing lotteries.

80% AMI (Moderate Income) - Target Population: Middle-income working families, teachers, nurses, city employees. Income Limits: 1 person: $75,600, 2 people: $86,400, 3 people: $97,200, 4 people: $107,900. Typical Rent: $1,890–$2,690/month.

100% AMI (Moderate-Middle Income) - Target Population: Dual-income households, established professionals. Income Limits: 1 person: $94,500, 2 people: $108,000, 3 people: $121,500, 4 people: $134,850. Typical Rent: $2,360–$3,360/month.

130% AMI (Middle Income) - Target Population: Higher-earning professionals who still need affordable options. Income Limits: 1 person: $122,850, 2 people: $140,400, 3 people: $157,950, 4 people: $175,305. Typical Rent: $3,070–$4,370/month.