Pitfall 1: Misunderstanding gross vs. net income. AMI is based on gross income (before taxes and deductions), not take-home pay. Don't calculate based on your paycheck—use your W-2 total.

Pitfall 2: Forgetting to include all income sources. HUD counts wages, self-employment income, Social Security, unemployment benefits, child support, alimony, investment income, and rental income from properties you own.

Pitfall 3: Not accounting for bonuses and overtime. If you receive a $10,000 annual bonus, that counts as income. If you work regular overtime, HPD will annualize it.

Pitfall 4: Ignoring household size rules. If your household size changes (new baby, partner moves in, elderly parent joins), your AMI calculation changes. You must notify HPD immediately.

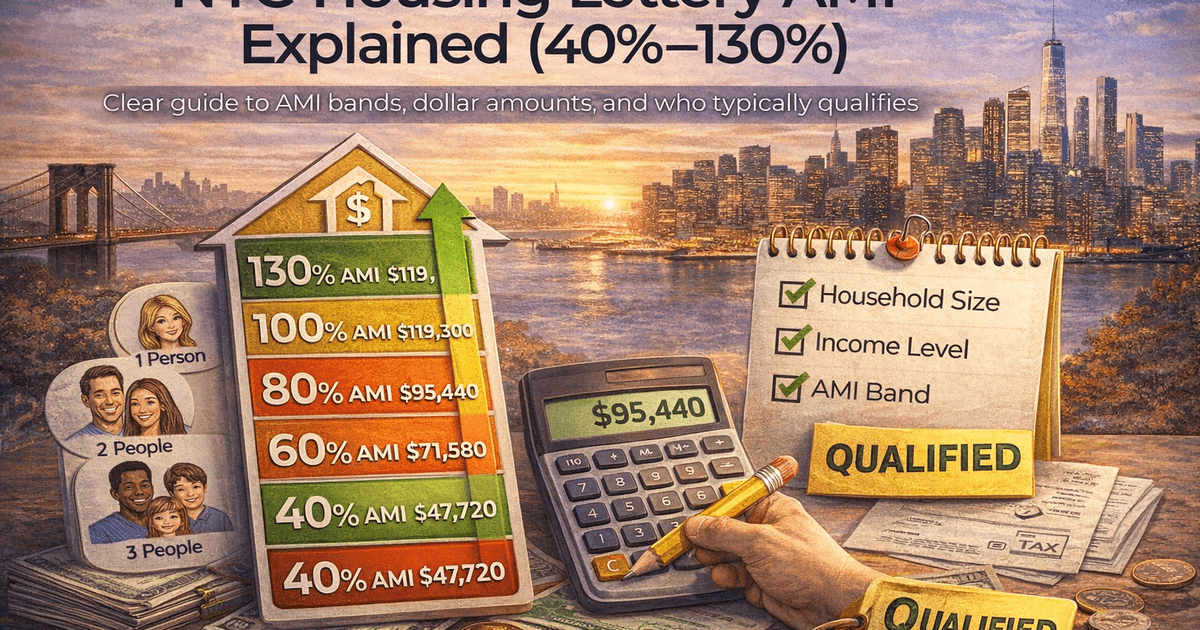

Pitfall 5: Applying to the wrong AMI band. If you earn $85,000 as a single person, you DON'T qualify for 60% AMI ($56,700 max for 1 person). Applying wastes your time and clogs the system.

Pitfall 6: Income increases after applying. If you get a $20,000 raise after submitting your application and it pushes you over the AMI limit, you must withdraw or risk disqualification during document review.

How to handle income changes: If your income drops (job loss, reduced hours), you may newly qualify for lower-AMI lotteries. Recalculate your AMI and adjust your application strategy.

Documenting complex income: If you have variable income (commission sales, freelance work, seasonal employment), HPD averages your income over 2 years. Bring detailed documentation during document review.